A bright idea for China: jump-start the economy with solar power push

- Beijing is right not to step in to rescue the ailing property sector, which would only reinflate the real estate bubble

- If it must use stimulus, it should dedicate around 3 per cent of GDP a year to boosting solar energy, which could make the country energy and food independent

Since the property bubble began around 2006, the government has repeatedly come to the rescue of the real estate market. But it stood firm last year and is likely to do so again. Faced with the US’ aggressive containment actions, Beijing’s priority is to cap downside risk, not risk everything on reviving the party or starting another.

Size doesn’t matter, though, if there are many disjointed bits. The national highway system has been key to China’s growth over the past two decades and remains its most important infrastructure. If China is going to implement another major stimulus programme, it has to focus on its productivity potential after the short-term demand boost.

The next productivity revolution will be in energy and China is in a perfect position to be the first to capitalise. In four years, solar cell prices have dropped by over 80 per cent to below 7 US cents per watt.

The key technology in solar power – the solar panel – is becoming almost irrelevant to the total cost. The price of solar cells has come down so much because production happens at a massive scale.

Innovation at scale is very powerful in pushing productivity. Other components of solar investment haven’t experienced the same price decline. Distributed and project-based solar investment in low-tech components doesn’t offer economies of scale.

Even at 70 US cents per watt – the overall development cost of solar power last year – China has a good case for scaling up solar power. It could deliver electricity to the power-hungry east from the sunny west at an even lower cost, not including the price of local distribution. Solar power is competitive against coal.

Nevertheless, solar accounted for only 4.7 per cent of the 8,388 trillion terawatt hours electricity output in 2022. And electricity from the grid only accounts for 27 per cent of China’s energy consumption. Despite its rapid growth in the past two decades, solar power remains insignificant in China’s overall energy picture. That shouldn’t be the case.

01:52

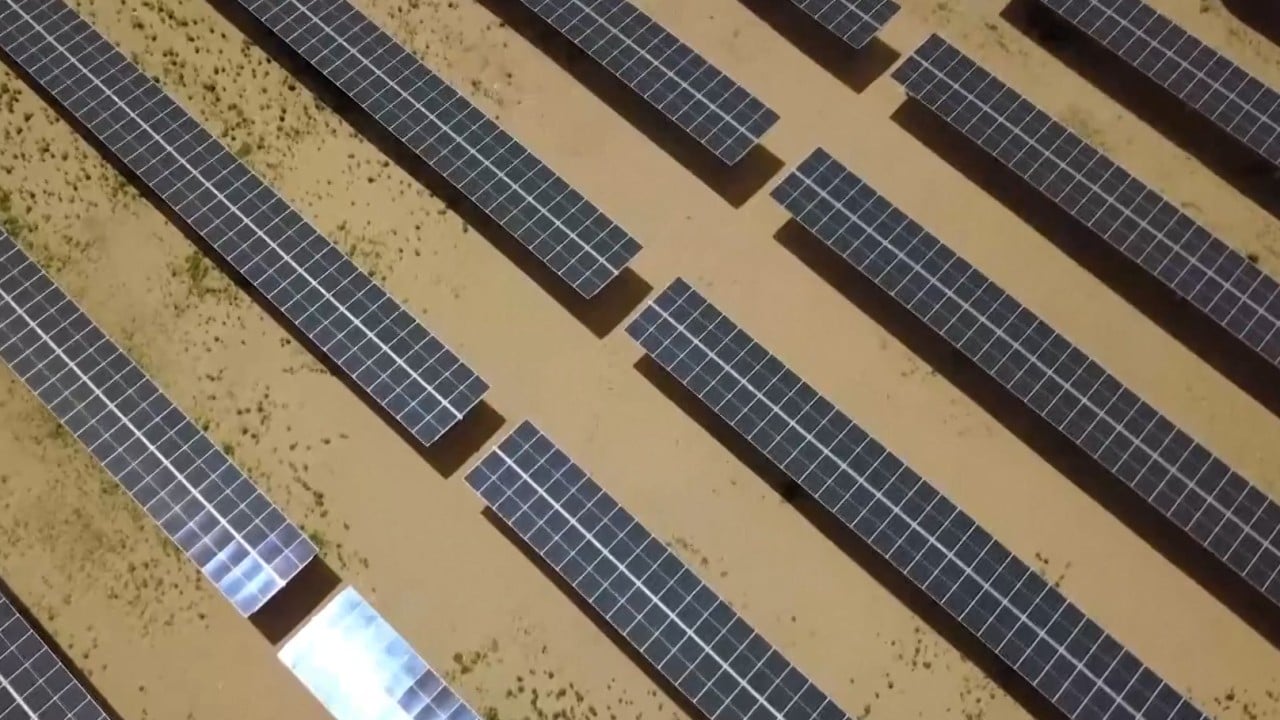

China starts first ultra-high power transmission project in the Gobi Desert

For example, if China were to complete a project to cover much of Taklamakan Desert, the scale efficiency would apply to every component in the solar investment. Autonomous systems could be developed for equipment production, installation and maintenance. Solar singularity could be reached.

Plentiful and near-zero-cost electricity would open up new possibilities. First, the coverage provided by solar panels and the water used to clean them could help the desert turn green and become grazing land.

Second, pumping water from the southern side of the Tibetan Plateau to the arid north would become economical, which could irrigate millions of hectares of land there. The solar push could make China energy- and food-independent.

Money must be spent on the future, not the past. Quantitative easing could revive the moribund property or shadow banking sector for a short time, but would merely delay the inevitable and worsen the aftermath.

The deflating bubble is good news for China. As the US keeps its bubble economy going, China has time to digest the cost of its own bubble deflating. Hopefully, when the US bubble pops, China’s economy will be healthy enough to withstand the shock.

Andy Xie is an independent economist